Declaration of contractor tax for Google, Facebook invoices

Declaration of contractor tax for Google, Facebook invoices

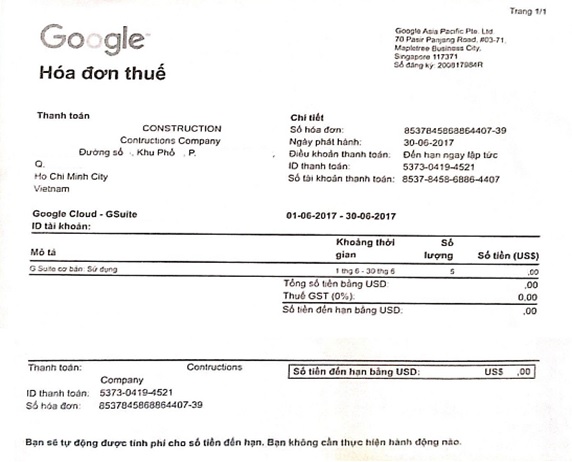

Question: My company uses Google and Facebook services to advertise, run online marketing, etc. pay by visa card, or mastercard under our personal name. What procedures does my company have to apply so that the invoices of Google and Facebook are included in the expenses?

Answer: Your company needs to register information with Google and Facebook so that when paying, Google and Facebook will issue an invoice with full information about your company. For bills under VND 20 million, you can pay by visa or mastercard under your name, and over VND 20 million, you should use a credit card under the company’s name or apply foreign currency payment procedures at a bank.

Because Google and Facebook do not have a company in Vietnam, you must declare and pay contractor tax for advertising invoices and run online marketing of Google and Facebook with the VAT and CIT rates of 5% each.

Therefore, when your company has invoices for operating services of Google and Facebook, making payments as instructed above, declaring and paying contractor tax and the above costs are included in company expenses when determining CIT.

The contents below are the procedures for declaring and paying contractor tax:

CONTRACTOR TAX DECLARATION PROCEDURE[1]

Step 1: Registering for a contractor tax code (used for all contractors with which the Vietnamese company signs a contract).

Within 10 working days from the date of signing the contract, the Vietnamese company is responsible for registering with the directly managing tax authority to register for a contractor tax code.

Pursuant to Article 33.2 Law on Tax Administration 2019:

“Taxpayers who directly register tax with tax authorities, the time limit for tax registration is 10 working days from the following date:

a) Receiving a household business registration certificate, establishment and operation license, investment registration certificate, establishment decision;

b) Starting a business for an organization not subject to business registration or a household business or individual that is subject to business registration but has not yet been granted a business registration certificate;

c) Having the liability for withholding tax and paying tax on its behalf; organizations submit on behalf of individuals under contracts, business cooperation documents;

d) Signing the contract of receipt of a contract with a foreign contractor or sub-contractor that declares and pays the tax directly to the tax authority; signing oil and gas contracts and agreements;

dd) Having personal income tax liability;

e) Having a request for a tax refund;

g) Having other obligations with the state budget”.

Pursuant to Article 5.3.(e) Circular 105/2020/TT-BTC:

“Organizations and individuals set forth in Article 4.2.(g) of this Circular withhold and pay on behalf shall be granted a 10-digit tax code (hereinafter referred to as tax code on behalf of) to declare and pay tax on behalf of foreign contractors, foreign sub-contractors, overseas suppliers, organizations and individuals with contracts or business cooperation documents. Foreign contractors and foreign sub-contractors specified in Article 4.2.(dd) of this Circular aren declared and paid by the Vietnamese party on behalf of the contractor, shall be granted a 13-digit tax code according to the tax code paid on behalf of the foreign contractor. Vietnamese party to confirm the fulfilment of contractor tax obligations in Vietnam”.

A dossier for registration of a contractor’s tax code includes

– Form 04.1-DK-TCT (Form 04-DK-TCT)

– A copy of the contract signed between the Vietnamese party and the foreign contractor (attached with a notarized copy of the business license for sure)

– List of foreign contractors and sub-contractors paying tax through the Vietnamese party, Form No. 04.1-DK-TCT-BK (Form số 04.1.ĐK.TCT.BK)

Submitted at the tax agency directly managing.

Pursuant to Article 7.6 Circular 105/2020/TT-BTC:

“For taxpayers who are organizations and individuals withholding and paying on their behalf, and organizations and individuals authorized to collect by tax authorities specified at Article 4.2.(g)(m) of this Circular shall submit tax registration dossiers to tax authorities as follows:

1. a) Withholding organizations and individuals shall submit tax registration dossiers on behalf of foreign contractors and foreign sub-contractors to the tax authority directly managing, including:

– Tax registration declaration Form No. 04.1-DK-TCT attached to this Circular;

– A list of contracts with foreign contractors and foreign sub-contractors paying tax through the Vietnamese party, Form 04.1-DK-TCT-BK.

No later than 03 working days after receiving the complete dossier, the tax authority will issue a notice of issuance of tax code according to Form 11-MST[2].

Step 2: Declaring contractor tax:

Contractor tax is declared each time payment is incurred. (For example: If the expense to be paid to the foreign party is VND 1,000,000, but only VND 600,000 has been paid, then calculate and declare contractor tax on the amount of VND 600,000).

The base for determining the amount paid is the service contract and the online transaction invoice or the debit note and the bank account statement.

The calculation and declaration of contractor tax shall comply with Circular 103/2014/TT-BTC, the VAT and CIT rate for activities providing services is 5%).

In case the Vietnamese party pays the foreign contractor many times a month, it is possible to register for a monthly tax return instead of declaring each payment arising. To register monthly contractor tax declaration, an official dispatch must be submitted to the Department of Taxation for management.

Within 10 days from the date of payment to the foreign contractor, the Vietnamese company shall make a declaration for payment of contractor tax. In the case of monthly declaration, the deadline for submitting the contractor tax declaration is the 20th day of the following month in which the tax liability arises.

Declaration form: 01/NTNN

Pursuant to Article 20.3.(a) Consolidated Document 15/VBHN-BTC, there is a paragraph:

“In case the Vietnamese party makes payments to the foreign contractor many times a month, they can register for declaration monthly tax instead of declaring each time payment to foreign contractors.”

Step 3: Finalizing contractor tax:

No later than the 45th day from the date of contract termination, the enterprise must submit the dossier of finalization of contractor tax.

The dossier includes:

– Finalization declaration Form No. 02/NTNN.

– List of contractors participating in the contract.

– List of tax payment documents

– A copy of the liquidation of contractor contracts

Article 44.5 of the Law on Tax Administration 2019:

“The deadline for submitting tax declaration dossiers in case of termination of operation, termination of contract or enterprise reorganization at the latest is the 45th day from the date of the event”.

Article 20.3.(e) Consolidated Document No.15/VBHN-BTC:

“Finalization declaration dossier:

– Finalization declaration of contractor tax, made according to Form No. 02/NTNN attached to this Circular;

– A list of foreign contractors and Vietnamese sub-contractors participating in the performance of contractor contracts, made according to Form No. 02-1/NTNN, 02-2/NTNN attached to this Circular;

– List of tax payment documents;

– A copy of the liquidation of the contractor contract (if any)”.

The contents above are about “Declaring contractor tax for Google and Facebook invoices”.

Nghiep Thanh Law thank you for visiting and look forward to receiving your feedback and suggestions.

Translator: Le Khanh Linh

Copywriter: Nguyen Linh Chi

Admin: Lawyer Thuan

CONTACT INFO

NGHIEP THANH LAW CO., LTD

Address: 136 Street No.1, Phuoc Kien Residential Area, Hamlet 5, Phuoc Kien Commune, Nha Be District, Ho Chi Minh City.

Transaction office: Room 21A6, 12 Ton Dan Street, Ward 13, District 4, Ho Chi Minh City.

Phone: (028) 3941 3688 – Hotline: Mr. Co 0984996971 – Lawyer Assistant

Email: info@luatnghiepthanh.com

Website: https://tuvanluat.vn

[1] Contractor tax is not a tax, but a way of calling and showing the tax amount that foreign contractors must pay when doing business and having revenue in Vietnam. Contractor tax that foreign contractors must pay is VAT and CIT. Vietnamese enterprises are responsible for declaring VAT and CIT on behalf of foreign contractors if foreign contractors do not make tax declaration.

[2] Article 8.5 Circular 105/2020/TT-BTC.